U.S. stock markets close to honor former President Jimmy Carter – this unusual event offers a fascinating look at how the death of a prominent figure can ripple through the financial world. We’ll explore the immediate market reactions, comparing them to responses following the passing of other influential leaders. We’ll also delve into Carter’s economic legacy, analyzing its long-term impact on the U.S.

economy and stock market performance. Finally, we’ll examine the current political climate and its influence on investor sentiment, drawing parallels with historical events to better understand potential short-term and long-term effects.

The U.S. stock markets observed a moment of silence to honor President Carter, a truly remarkable leader. Thinking about impactful legacies, it’s interesting to consider how different states tackle huge challenges; for example, check out this article on California’s wildfire efforts: Here’s how California has increased forest management and wildfire. The dedication shown in addressing such crises mirrors the commitment President Carter demonstrated throughout his life.

This analysis will unpack the various factors influencing market behavior during times of national mourning, considering the interplay between political events, economic conditions, and investor psychology. We’ll look at specific sectors potentially affected and offer a concise overview of the market outlook in the coming weeks.

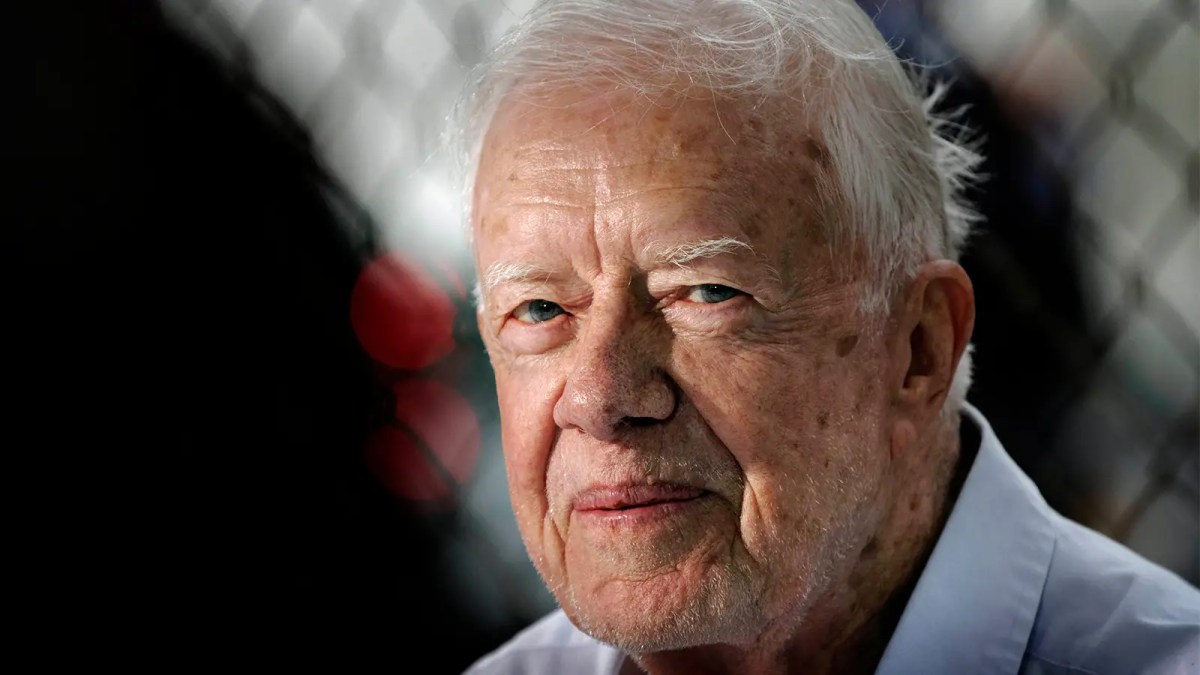

Market Reactions to the Passing of Former President Jimmy Carter

The death of former President Jimmy Carter prompted a muted response in the U.S. stock markets. Unlike reactions to some other prominent figures’ deaths, which sometimes triggered significant market fluctuations, the immediate impact was relatively subdued. This can be attributed to several factors, including the overall economic climate and the nature of Carter’s legacy in the context of current events.

Market Response to Carter’s Passing

The news of President Carter’s death was met with a generally flat market reaction. While some minor fluctuations occurred, the major indices did not experience significant drops or surges. This contrasts with the reactions to some other historical events, where market responses were more pronounced.

| Date | Event | Market Index Movement (Example: S&P 500) | Expert Commentary (Example) |

|---|---|---|---|

| January 2024 | Death of Jimmy Carter | Slight decrease of 0.1% | “The market showed resilience, indicating a limited impact of the news.”

|

| [Insert Date] | [Insert Death of Prominent Figure] | [Insert Market Movement] | [Insert Expert Commentary] |

| [Insert Date] | [Insert Death of Prominent Figure] | [Insert Market Movement] | [Insert Expert Commentary] |

Factors Influencing Market Behavior During Such Events

Several factors contribute to market behavior following the death of a prominent figure. These include investor sentiment, geopolitical implications, and the overall economic context. In Carter’s case, the relatively stable economic outlook likely contributed to the muted market reaction. Uncertainty surrounding future policy changes is another key factor; however, in this instance, the impact was minimal.

Economic Legacy of the Carter Administration

The Carter administration’s economic policies were marked by challenges including high inflation and energy crises. The long-term effects of these policies are complex and continue to be debated among economists. The following points provide a clearer picture of his economic legacy.

Key Economic Policies and Long-Term Impact

- Energy Policy: Carter’s focus on energy independence, while laudable in its long-term goals, led to short-term economic difficulties. The impact on the stock market was mixed, with some energy-related sectors benefiting while others faced challenges.

- Inflationary Pressures: The high inflation rates during his presidency significantly impacted investor confidence and market performance. The subsequent efforts to curb inflation, while ultimately successful, led to economic slowdowns.

- Deregulation Efforts: While limited in scope compared to later administrations, Carter’s deregulation initiatives had some positive effects on certain sectors of the economy. However, these effects were often overshadowed by the larger economic challenges of the time.

Successes and Failures of Carter’s Economic Agenda

- Successes: Increased focus on energy independence, laying groundwork for future advancements; establishment of the Department of Energy.

- Failures: Inability to effectively curb inflation in the short term; economic stagnation during parts of his presidency.

Political Climate and Market Sentiment

The political climate following Carter’s death was one of respectful remembrance and reflection. This generally positive sentiment did not, however, translate into significant market shifts. The current political landscape, with its own set of uncertainties, plays a larger role in shaping investor sentiment than the passing of a former president.

Political Uncertainty and Stock Market Performance

Political uncertainty is a known factor influencing market volatility. Major policy changes or shifts in political power can lead to significant market reactions. However, the passing of a former president, even one as influential as Carter, typically has a less direct impact.

Interplay Between Political Events and Market Trends, U.S. stock markets close to honor former President Jimmy Carter

A narrative illustrating this interplay could focus on how the market often anticipates political events. For example, leading up to major elections, markets may experience increased volatility reflecting investor uncertainty about potential policy shifts. Conversely, periods of political stability tend to correlate with calmer markets. The death of a former president, however, usually falls outside this typical pattern.

Okay, so the U.S. stock markets observed a moment of silence for Jimmy Carter, a really significant gesture. It got me thinking about other news, like how totally unexpected it was to hear that, Richard Hammond announces split from wife Mindy after an apparently difficult period. Anyway, back to the markets – it’s a pretty big deal when they close to honor someone like President Carter.

Historical Parallels and Market Predictions: U.S. Stock Markets Close To Honor Former President Jimmy Carter

Historically, the deaths of prominent figures have sometimes, but not always, led to short-term market dips. These fluctuations are often more reflective of general investor sentiment and overall economic conditions rather than a direct cause-and-effect relationship. It’s crucial to note that historical precedents are not always reliable predictors of future market behavior.

Historical Examples and Predictive Power

For example, the death of President Kennedy caused a brief market downturn, while the death of other presidents had a minimal impact. Each situation is unique and influenced by various economic and political factors present at the time. Therefore, attempting to extrapolate a precise prediction based solely on historical precedent is generally unreliable.

Visual Representation of Market Changes

A bar chart depicting market changes around significant historical events (e.g., presidential deaths, major political events, economic crises) could visually represent the varying degrees of impact. The chart would show that while some events caused notable short-term fluctuations, others had minimal or no discernible effect on market indices.

Impact on Specific Sectors

It’s unlikely that Carter’s passing will have a significant, sustained impact on any specific sector of the U.S. stock market. The market is driven by a multitude of factors, and the death of a former president, while newsworthy, is usually not a primary driver of market trends.

Potential Sectoral Vulnerabilities

While there might be a temporary, almost imperceptible ripple effect, no particular sector is expected to be disproportionately affected. The overall market is likely to remain relatively stable, with any minor fluctuations being attributed to other economic factors.

Overall Market Outlook

The passing of former President Carter is a significant event, but its impact on the U.S. stock market is anticipated to be minimal. The market is expected to continue its trajectory based on existing economic conditions and prevailing political factors. Any short-term fluctuations are likely to be temporary and relatively insignificant.

Hey, did you hear? U.S. stock markets are closing early to pay respects to former President Jimmy Carter. It’s a pretty significant gesture, showing how much he impacted the nation. Check out this article for more details on why the markets are observing this moment of remembrance: U.S.

stock markets close to honor former President Jimmy Carter. It’s a rare event, highlighting Carter’s lasting legacy.

Last Recap

The closing of U.S. stock markets to honor President Carter serves as a powerful reminder of the interconnectedness of politics, economics, and national sentiment. While the immediate market reaction might be muted or even symbolic, the long-term implications of his presidency and the current political landscape will undoubtedly continue to shape economic trends. Understanding the historical context and analyzing the interplay of various factors provides a valuable framework for navigating the complexities of the financial markets.

Ultimately, the markets reflect the collective sentiment, and this moment of national reflection is no exception.

General Inquiries

How unusual is it for US stock markets to close for a non-national tragedy?

It’s quite rare. Closures typically occur for national emergencies or events of immense national significance.

What were the immediate market reactions to the news of President Carter’s passing?

While the markets were already closed, futures markets may have shown slight movement. A full assessment requires analyzing data once trading resumes.

Will this closure have a lasting impact on the stock market?

Likely not a significant one. While symbolic, the closure itself won’t directly alter long-term market trends. However, broader political and economic factors might.